Every post in the Matereal World includes at least one actionable recommendation. Today’s might be jarring so I will set it up a little first.

When it comes to priorities around ESG and sustainability, there is often a disconnect between what is said by company executives to the investor community compared to other audiences. That’s not the jarring part—that’s old hat, though I will use Danone as an example to make the point. What is potentially jarring is what I recommend you do about it if you recognize this in the organization where you work.

What I don’t recommend

What others often recommend is to harmonize messages, something like this:

Weave ESG and sustainability messages into earnings call commentary and investor presentations;

Brief executives on key messages to support responses to questions that emerge during the investor Q & A.

I officially unrecommend the above approach because it is about how to communicate consistently, regardless of reality. If reality is crappy, we need to change reality, not the things we communicate about it.

What I DO recommend

When there are inconsistencies across investors communications versus other audiences regarding ESG and sustainability priorities, I recommend the following steps.*

Notice the inconsistencies in messaging, and then…

Clarify the scope of the inconsistencies, and then…

Chart your alternative path.

* All three steps are required.

To create an economy that works in service of life, we need to notice where the current economy is undermining life. Where it’s killing us and our biosphere. Where it proposes to make us healthier while making us less healthy. Where it pretends to bring joy and freedom while tethering us to addictive, harmful products. Stuff like that.

I’m not suggesting this is trivial (au contraire, I’m suggesting this can be jarring). But it is necessary, and workable. Understanding how financial capital is being prioritized is a good way to see that stuff.

Let’s have a look.

1. Notice inconsistencies in messaging

Step one is to simply notice inconsistencies in messaging shared with investors, compared to other audiences. In particular, listen for “strategic pillars” or “priorities,” i.e. the signals to investors about plans for financial success. Do they line up with the priorities mentioned in sustainability reports and ESG communications? What’s different? What’s the same?

For example, inconsistencies came to my attention with French food giant Danone when I conducted a Matereality assessment on them last year. Their website hosts content about what it means to be a €27billion B-Corp. There are nice pictures and stories, and a whole microsite on regenerative agriculture. But in recent investor calls and presentations, they barely touch “sustainability” and it certainly doesn’t come across as a strategic priority.

Mind you, it wasn’t always so.

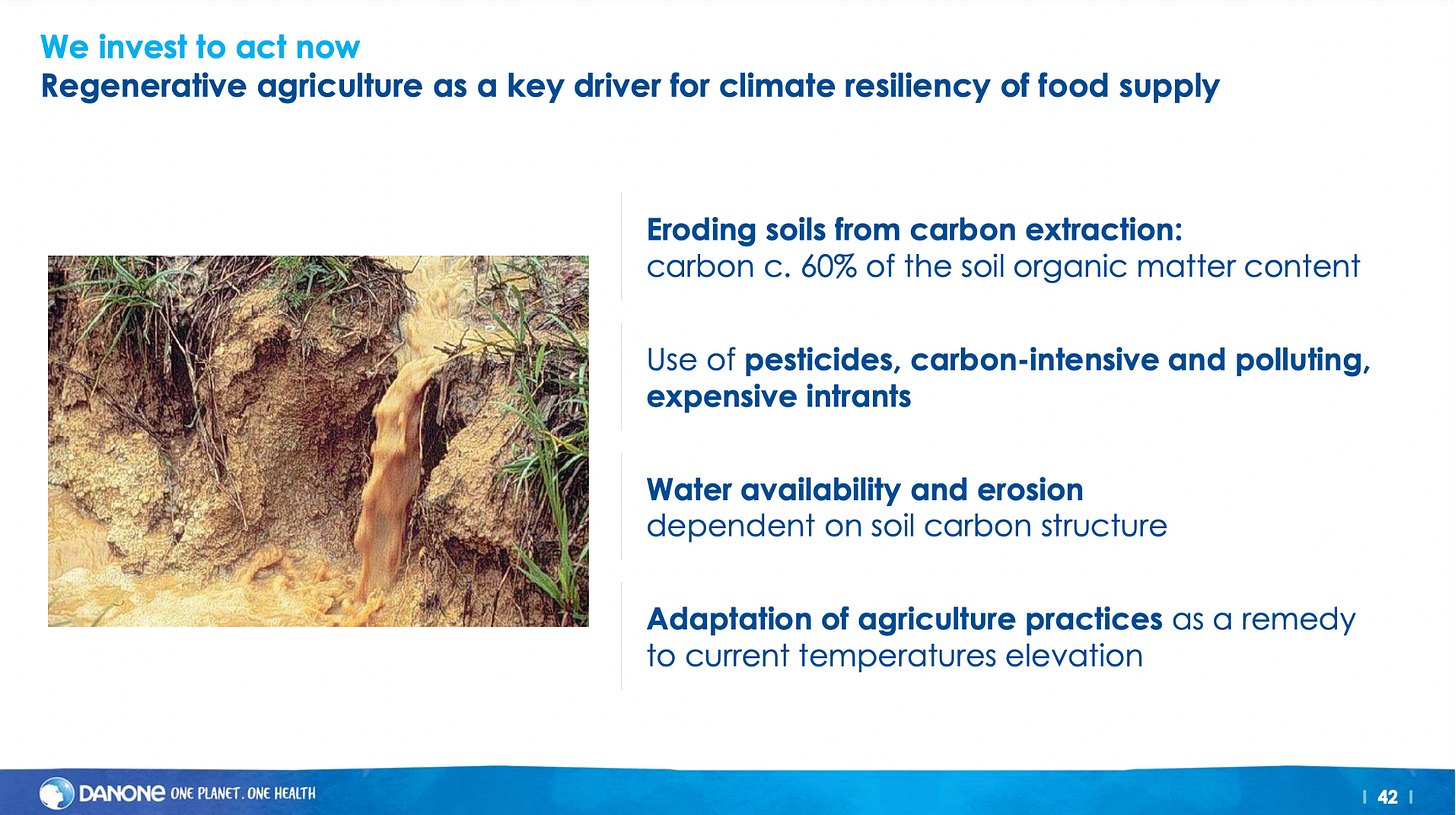

Once upon a time, Danone’s CEO recounted strategic priorities tethered to reality. He talked about soil health, pollution, even pesticides—real things that matter to a global food company and the communities it touches.

I got goosebumps listening to a 2019 call with then-CEO Emmanuel Faber who used words like “soil” and “agriculture” dozens of times in his remarks to investors. It resonated because that’s what the company is dependent on for all of its products. Why not clarify the needed strategic changes for investors?

Following are two snapshots of the presentation deck from that goosebump-worthy Q4 2019 earnings call, where Faber walked call participants through grounded data as a rationale for making regenerative agriculture a strategic priority. The first image is not a pretty picture, but that’s because industrial agriculture is, well, not pretty.

He went on to explain Danone’s strategy to address this. The plan was far from perfect, but it was real information related to how life actually works.

Fast forward three years later: Faber is no longer CEO (le sigh), and like so much dirt under new CEO Antoine de Saint-Affrique’s fingernails, the words “soil” and “agriculture” are scrubbed from his remarks during the 2022 annual earnings call. The strategic pillars in the new presentation deck look about as sanitized as any global communications team could muster. The use of the word “seed” as a pillar feels like a proverbial poke in the eye to the soil imagery of yore.

No more goosebumps for me. Now I feel kind of nauseous when I review their earnings calls and compare the commentary to, for example, their Regenerative Agriculture webpage where they claim “…agriculture is at the heart of what we do.”

Danone’s investor dialogue no longer includes anything other than vague phrasing about “sustainability”, not tied to anything specific (or sustainable for that matter). Agriculture is stated as the heart of what they do, yet it is not relevant to how money is earned and reported.

This is, to be blunt, highly inconsistent.

2. Clarify the scope of the inconsistencies

Now that we can’t unsee these glaring inconsistencies, we need to discern: is this representative of a lack of action, or a quirk of tailored messages for certain audiences? Folks on the inside of a company will know better where true priorities lie. Being on the outside, I needed to conduct a deeper analysis to understand the scope of the disconnect.

Based on the (free, public) Danone Matereality assessment I conducted, including a review of earnings calls and investor presentations, I would describe the disconnect as way beyond a messaging issue. I wrote extensively about this, in “Regenerative” vs Actually Regenerating. Here’s one key finding:

Although there is a lot of communication on regenerative agriculture, there isn’t a lot demonstrating what is being regenerated.

It seems to be about “improving practices” to address some of the most egregious impacts that industrial agriculture created in the first place.

In other words the scope of the inconsistencies is vast. And what surfaced in my Matereality assessment was beyond agriculture, by the way. There are inconsistencies pertaining to plastic waste, unhealthy ingredients, and more.

This inconsistency is core to the business—it is fundamental to every product the company sells. It relates to key elements of the brand and its “healthy” messaging.

The disconnect challenges the very purpose of the company, “bringing health through food to as many people as possible”.

Health does not come from dying soils, failing biodiversity, toxic chemicals, or single-use packages that mostly ends up landfilled, incinerated, or “uncontrolled” (in spite of being “84% recyclable, reusable or compostable” according to the company.

Yet investors are kept in the dark about these realities.

3. Chart your alternative path

In step three, the careful noticer encounters a fork in the road. We cannot unsee these inconsistencies once they are seen. What to do? This will vary depending on roles and inclinations.

There are often reasons to do very little. These reasons typically boil down to concerns about a loss of comfort of some sort—financial, emotional, or otherwise. I empathize with this but I don’t recommend the approach any more than I recommend fixing the communications instead of addressing the harmful reality.

Maintaining the status quo is spiritually exhausting at an individual level, and morally short-sited at a community level.

Once we know and do nothing, we are complicit. If it’s any consolation, I have found that busting out of the life-undermining economic paradigm is way more fun, or at least more liberating.

Sometimes the response leads to urges that get acted on, such as a round of stakeholder engagement to understand diverse needs, with a vague plan to improve over time. But without a conscious change of direction ***from those who steer the company*** that will just be more busy work.

In my experience, about 90 % of the senior sustainability professionals’ job consists of fascinating project work that distracts from and/or ensures they are too exhausted to address the core direction of travel of the business—which they are not invited to influence, anyway. (The other 10 % is developing external reports and messaging, by the way.)

There are infinite options for alternative paths. There is no one path here. I have a sense of what it isn’t (e.g. a new ESG framework, more ambitious sustainability goals, or another round of stakeholder engagement). Perhaps you steer the company and you will now regularly say strategic things to your investors about what must change. Perhaps you manage communications and will now put your foot down on cherry-picked stories that miss the point, instead showing the truth about things you know aren’t going well. Or perhaps you will choose to something else entirely.

What you do about the inconsistencies in what a company says it lives for, versus how it actually lives, is up to you. Whatever you do, I urge you to cross the threshold into your new role as Chief Noticing Officer and go from there.

Recap: Notice, clarify, change.

Notice what is inconsistent. Clarify how it relates to purpose, strategy, and resource allocation in service of life. And then change your role to make things right (or at least, no longer contribute to making them wrong).

Tuck what you notice into your breast pocket, close to your heart, as evidence that you are not crazy, that you are part of a gas-lighting process that allows companies to say one thing while financing another. And then do something about it.

If you need more, add this your breast pocket—or if it’s getting bulky in there maybe paste it to your bathroom mirror:

You are not alone. And you always have choices.

Bonus Track: How to find company investor call transcripts

I discuss how to explore investor calls in detail during this conversation with Geoff Kendall, founder of the Future-Fit Business Benchmark and the Transition Agency. It can be hard to find call transcripts but I have a go-to spot, Seeking Alpha. Instead of wasting time scrambling around company websites, I go straight there. This is an affiliate link—if you sign on to the premium version (which I did years ago and have been very happy with it—hence becoming an affiliate the other day) I earn a small commission. The video with Geoff offers details about how I use the site (much of which is free so anyone can do this).

Do you know of examples of a company whose investor communications line up beautifully with what society and the biosphere need to thrive? Please share in the comments—I’d love to have a look! Other Matereality ideas and questions welcomed, too.

Know someone working to make the shift towards industrial healing, who might benefit from hanging around in the Matereal World?

The needed investment to subscribe to the Matereal World is currently $0! If you’d like to subscribe, here’s a button to click so you can add it to your portfolio.

Excellent - I love the action you recommend right at the top. I also love that, even though this is a hard path to suggest companies tell the truth in their communications about the impact of their actions, you give such clear direction that it's possible to see how to take the first step.